2025 State Individual Income Tax Rates and Brackets

One major aspect of personal finance is taxes, which differ from state to state in the United States of America. But until 2025, you still best know how the state individual income tax brackets and rates work. In this blog, we will cover everything that you should know about state income taxes, how they work, and how they will affect your personal finances.

What Are Income Tax Rates and Brackets?

Income tax is a tax on earnings, and the government receives the payment. Individual states determine tax rates and brackets, which outline how much citizens must pay according to their level of income.

Understanding Tax Brackets

A tax bracket is an income range that is taxed at a specific rate. States don't tax everything at the same rate but classify income into various levels, and each level is taxed differently. It's a progressive system because the more money you earn, the greater the percentage of income that goes towards tax.

5% - upto 25000

7% - from 25001 to 50,000

9% - above 50,000

if income is >50000, it is not taxed at a flat rate. Instead as a

First 25,000 - 5%

Next 25,000 - 7%

Remaining Amount - 9%

This method ensures that people with lower incomes pay a lower overall tax rate compared to those earning higher amounts.

Types of State Income Tax Systems

Not all states follow the same tax structure. There are three main types of state income tax systems in the U.S.:

1. Progressive Tax System

Most states apply a progressive system of taxation, wherein income is segregated into brackets, and increased earnings are taxed at a higher rate. The system is comparable to the federal system of taxation. States such as California, New York, and New Jersey employ this technique.

2. Flat Tax System

A few states impose a flat tax rate, whereby all people pay the same percentage of income regardless of the amount they make. This is an easier system to calculate and less complicated. Flat tax states include Colorado, Illinois, and Pennsylvania.

3. No State Income Tax

Some states have no income tax whatsoever. They make their money from property taxes, sales taxes, and other charges. The following are the states with no individual income tax as of 2025:

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming

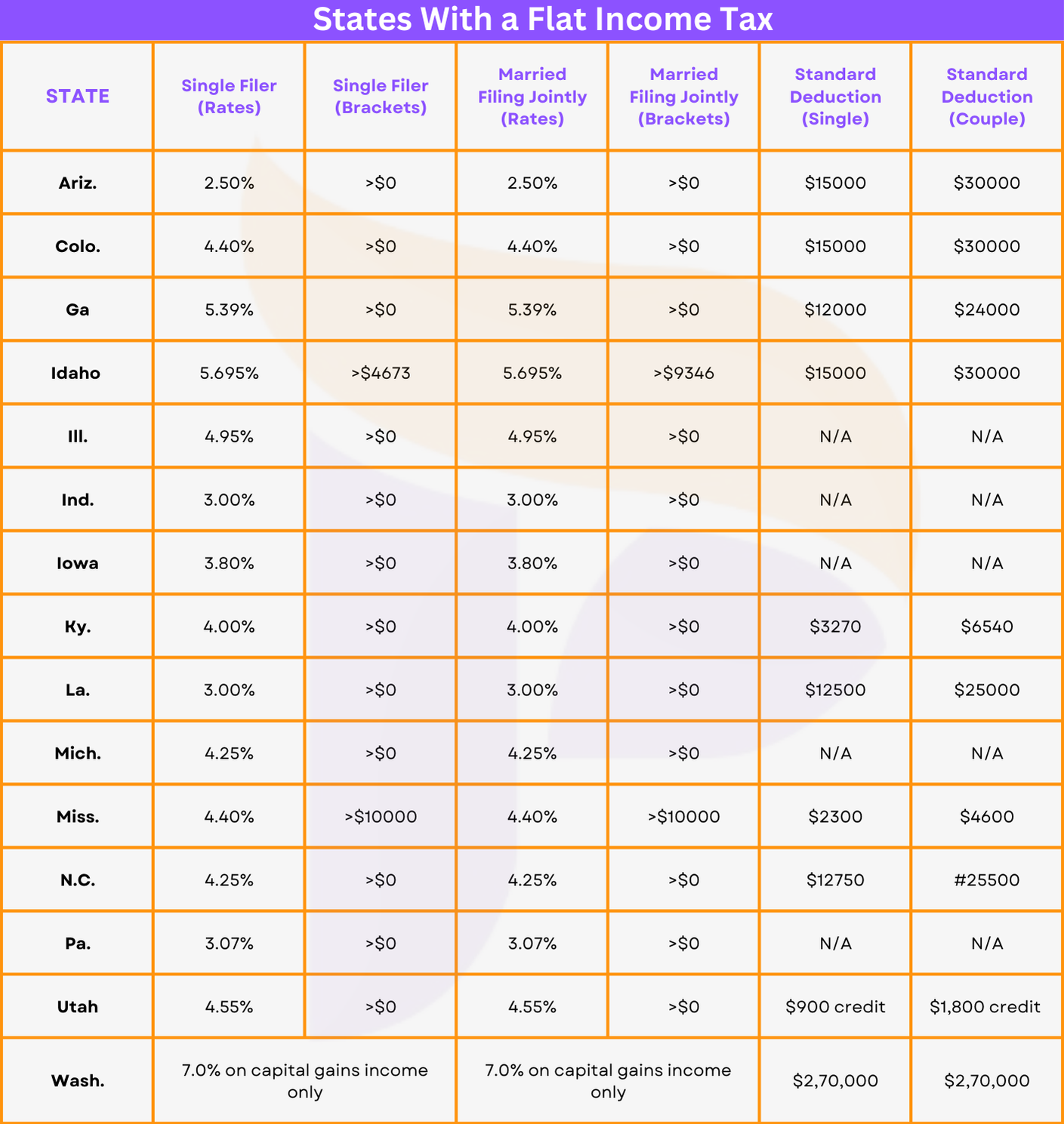

States With a Flat Income Tax

Note: These tax rates may change, always check with your state government tax authority for the latest update.

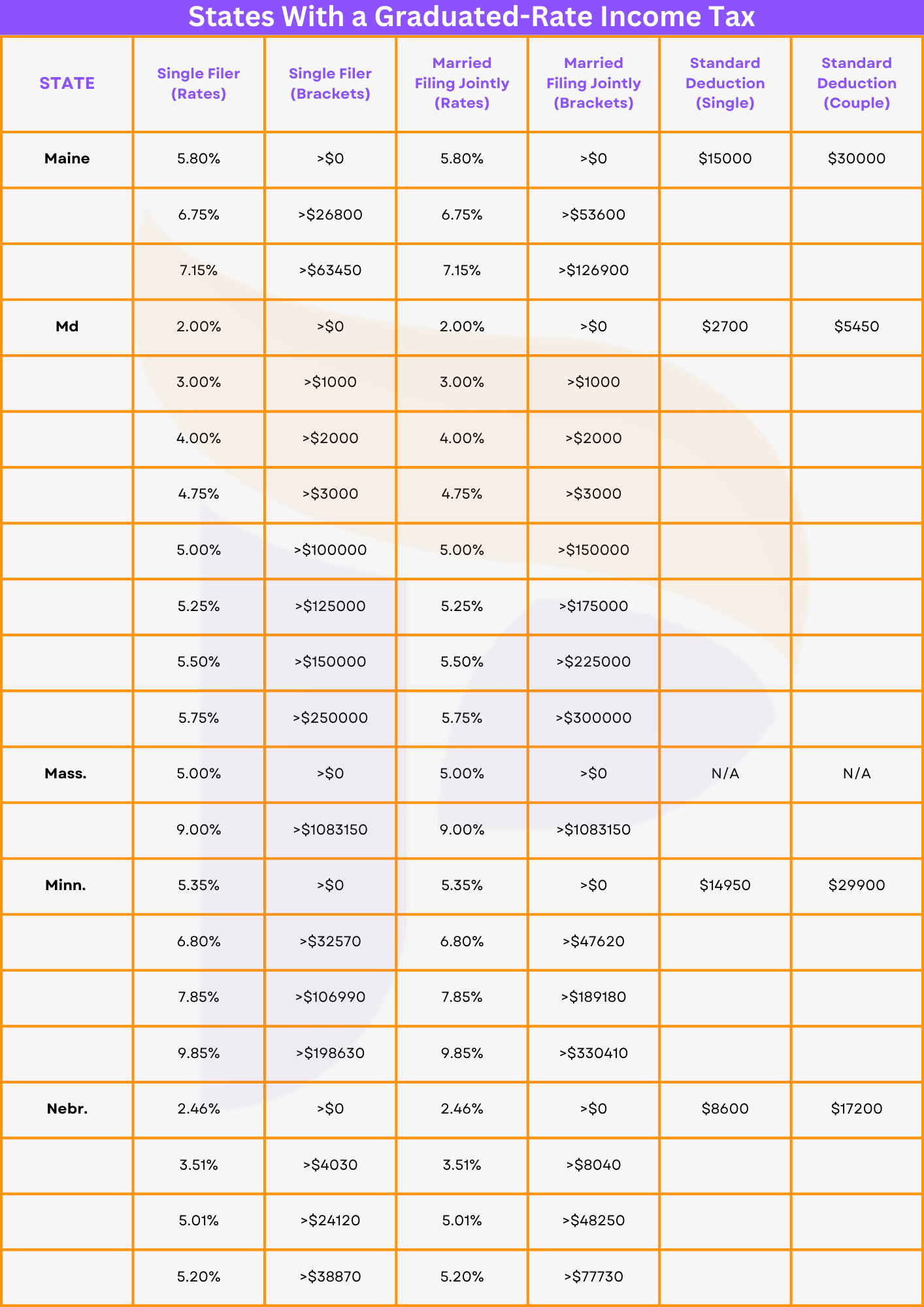

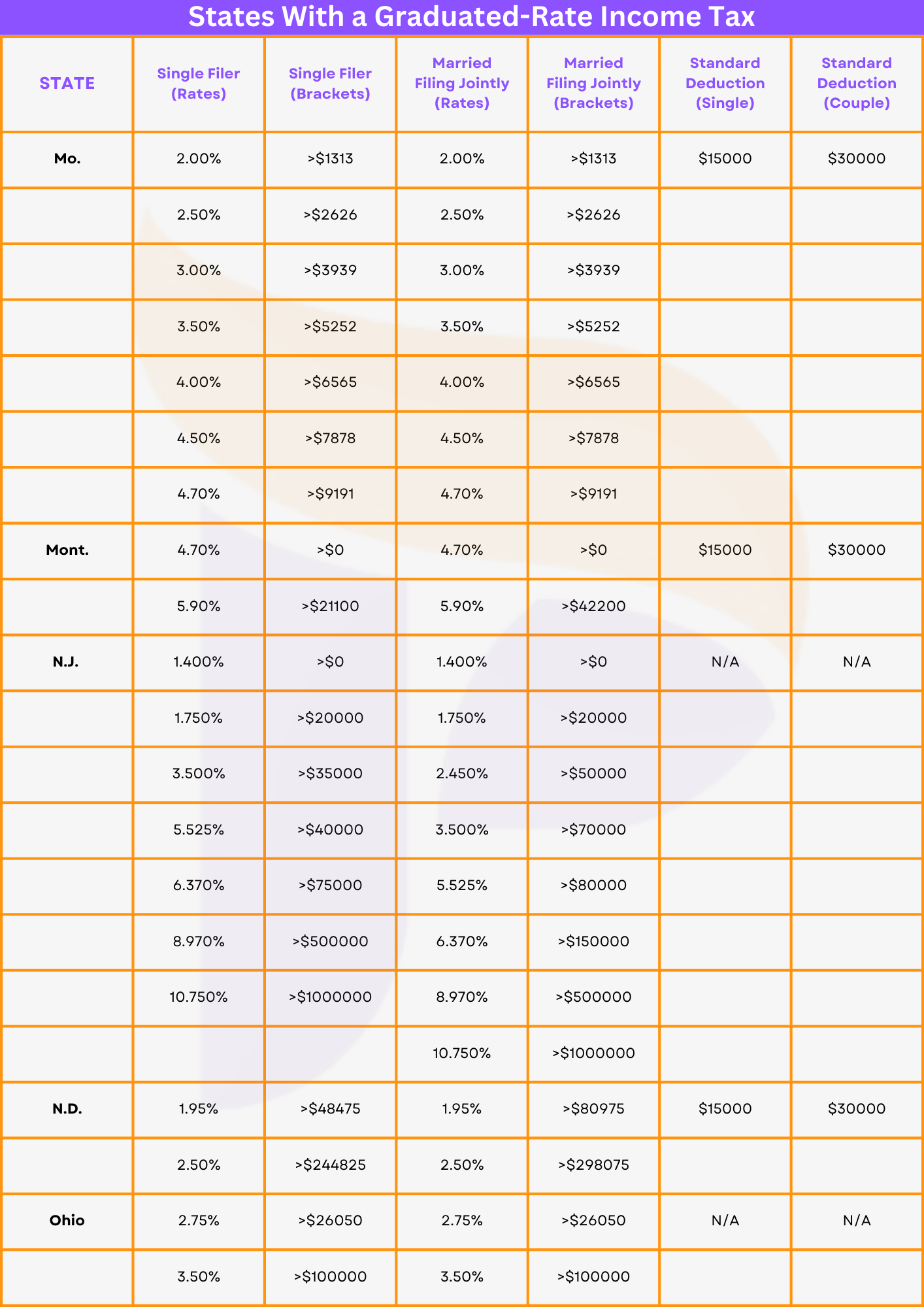

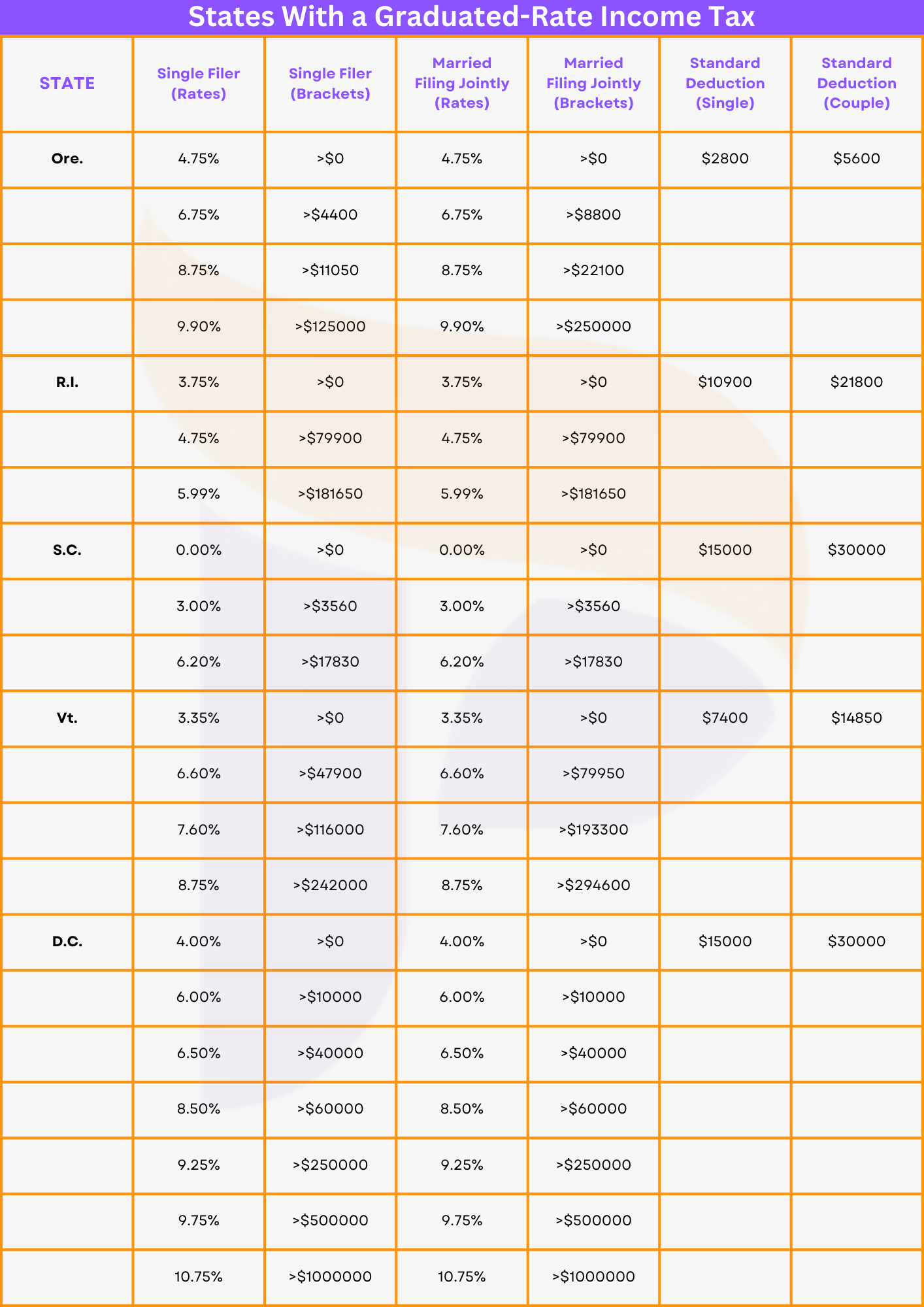

States With a Graduated-Rate Income Tax of 2025

Note: These tax rates may change, always check with your state government tax authority for the latest update.

Why Do States Have Different Tax Rates?

Different states have different budgets and needs, which dictate how much tax revenue is needed. States without an income tax tend to rely more heavily on other sources of taxation, such as increased sales taxes or property taxes. States with higher income taxes, on the other hand, may have more public services such as education, healthcare, transport, etc.

For instance:

- California has a high-income tax to support social programs.

- Texas doesn’t tax income but has higher property taxes.

- Florida depends on tourism and sales taxes.

How State Income Tax Affects You

Your state income tax rate affects how much money you receive after taxes. Here's why it's necessary to know your state's tax system:

1. Tax Planning

If you understand your tax bracket, you can plan tax payments and not be surprised by tax time.

2. Relocation Decisions

State income tax rates are frequently a factor in many people's decisions on where to live. Retirees, for example, will move to states that have no income tax so they can keep more of their retirement savings.

3. Business and Job Opportunities

Some states offer tax relief to companies, which means more employment opportunities in such states.

Conclusion

State income taxes in 2025 can differ widely, depending on where you live. Some of them are progressive, high-tax; some are flat; and some do not tax your income at all. Knowing how tax brackets work can help you better plan your finances and make smart decisions about work, savings, and even where you live.

If you need help with your state's tax rates, it would be a good idea to reach out to a tax professional or, if it's available in your area, your state's taxing authority for more information.