Understanding Social Security, Medicare, and Disability Insurance Contributions for 2024 and 2025

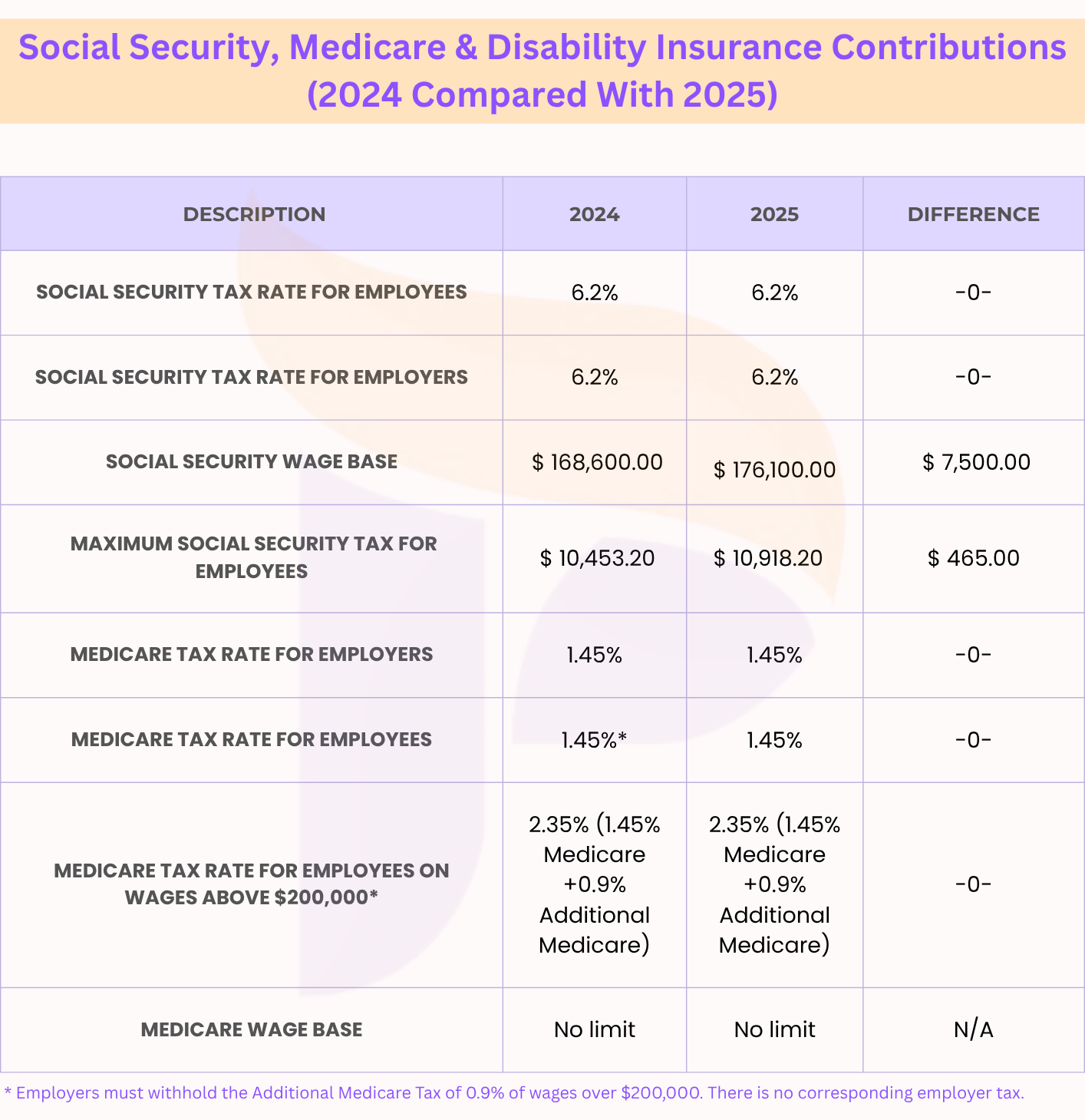

When dealing with payroll taxes, it is essential for employers and employees to note Social Security and Medicare contributions (taxes), as well as owed to the state disability insurance (SDI) that might vary from SDI in other California-named states, which would be a considerable amount impacting both employees' and employers' earnings. The below table presents an overview of the rates and changes 2024-2025:

Social Security Contributions

1. Social Security Tax Rates:

Employees: The Social Security tax rate continues to be 6.2% for the year 2024 and 2025.

Employers: The employer's rate continues to be 6.2%.

2. Social Security Wage Base:

The Social Security wage base has been raised from $168,600 in 2024 to $176,100 in 2025 reflecting an increase of $7,500.

3. Maximum Social Security Tax:

For workers, the highest Social Security tax that can be paid has risen from 10,453.20 in 2024 to 10,918.20 in 2025, reflecting a $465.00 rise.

Medicare contributions

1. Medicare tax rates:

Both employees and employers will continue to pay Medicare tax at a rate of 1.45%. The rate has not changed from 2024, and it will not change in 2025.

2. Additional Medicare tax for high income earners:

Employees earning wages above $200,000 will be subject to the Additional Medicare tax of 0.9% in addition to the normal 1.45% Medicare tax, for a total of 2.35%. The rate has not changed from 2024.

3. Medicare wage base:

Unlike Social Security, the quality of wages subject to Medicare tax is unlimited, meaning all wages are subject towards Medicare tax with no cap.

Disability Insurance

The table does not provide specific changes for disability insurance contributions which can change from state to state and based on local contributions.

In Conclusion, Social Security and Medicare tax changes are focused on revising the wage base on wage growth, as well as inflation while maintaining the tax rates consistent. These taxes are extremely critical in financing critical social programs, particularly for the retirees who rely on Social Security and Medicare beneficiaries. Understanding these changes can assist employees and employers in identifying their payroll requirements and abiding by tax-related matters, as well as budgeting for required financial obligations in the next fiscal year.