IRS Announces 2025 HSA Contribution Limits and HDHP Adjustments: What You Need to Know

The IRS has released the updated Health Savings Account (HSA) contribution limits and related figures for calendar year 2025, as outlined in Revenue Procedure 2024-25. These annual inflation adjustments are critical for individuals and families looking to maximize their tax-advantaged healthcare savings.

What is a Health Savings Account (HSA)?

An HSA is a tax-favored savings account for people who are covered by High-Deductible Health Plans (HDHPs). HSAs permit you to put pre-tax dollars that may be used to pay for qualified medical expenses, such as copays, prescriptions, vision and dental services, and more.

Triple Tax Advantage of an HSA:

1. Contributions are tax-deductible.

2. Earnings grow tax-free.

3. Withdrawals for qualified medical expenses are tax-free.

To be eligible for an HSA, you will need to be enrolled in an HDHP and meet additional qualification requirements. It's perhaps the strongest savings resource available for paying medical bills and planning retirement healthcare expenses.

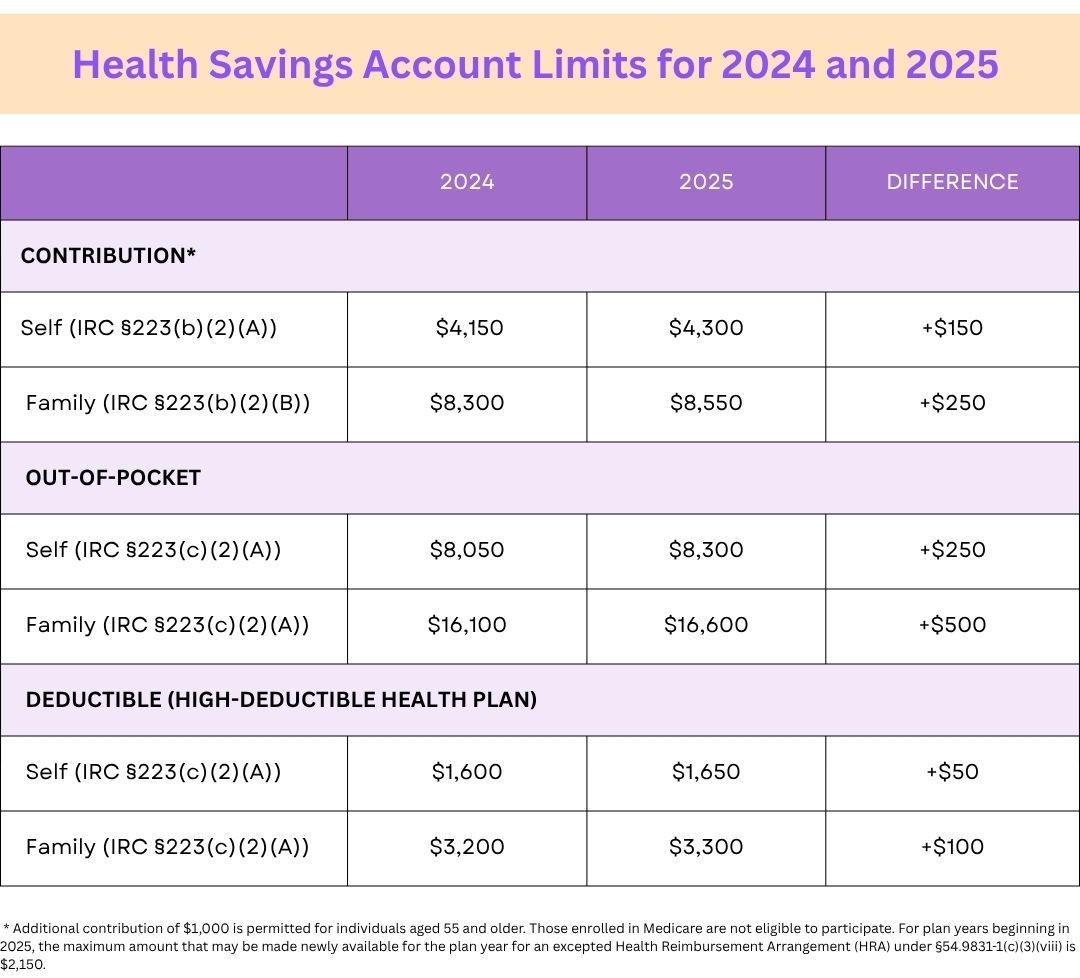

The IRS has published the 2025 inflation-adjusted Health Savings Account (HSA) limits, including contribution limits, high-deductible health plan (HDHP) minimums, and out-of-pocket maximums. These changes are included in Revenue Procedure 2024-25 and become effective Jan. 1, 2025.

Here, we outline the new numbers and compare with the 2024 limits.

What's the Impact of These Changes?

The rising contribution limits allow both individuals and families to save more tax-free dollars on eligible healthcare costs. The increased out-of-pocket maximums and minimum deductible levels acknowledge the continued upward trend of healthcare expenses.

These adjustments are especially important for:

Tax planning: HSAs reduce taxable income.

Retirement strategy: Unused HSA funds roll over and grow tax-free.

Employers: Helpful in structuring employee benefits packages.

Key Takeaways

-Self-only HSA contribution limit increases by $150

-Family HSA contribution limit increases by $250

-All HDHP requirements and out-of-pocket thresholds rise slightly

-Excepted Benefit HRA maximum rises to $2,150

-$1,000 catch-up contribution for those 55+ remains unchanged

Final Thoughts

The inflation-adjusted limits in 2025 for HSAs are small increases, but they represent the same trend of rising costs in the healthcare space and provide a little more space for tax-advantaged savings. HSAs are among the best, most flexible, and tax-efficient methods to spend on healthcare expenses and to save for the long run.

No matter if you are an employee, self-employed, or an employer sponsoring benefits, now is the time to begin considering the health savings strategy you will be implementing in 2025.

Disclaimer: This blog is informational only. The reader should work with a licensed tax advisor or licensed financial planner to assess how these IRS changes impact their situation.